Polynomial The New DeFi Derivatives Powerhouse Built on Synthetix

Kubesqrt

about 1 month ago ·

11 min read

Polynomial is one of the new exciting projects having launched on Optimism in recent weeks. So what is it, yet another option protocol or something more?

In short: Polynomial is the first option-selling vault to use an on-chain AMM to execute strategies.

In the past, options were used almost exclusively by traditional financial institutions and only accredited investors had access to this opportunity. This excludes most of the retail investors, just think about the WSBets crowd with Robinhood etc. With the emergence of DeFi, projects started democratizing many financial instruments and derivatives like options in particular. First on centralized crypto exchanges and later through on-chain option protocols.

First iterations of option exchanges were focused on just buying and selling options peer-to-peer. This requires some sophistication on behalf of investors as options are more difficult to understand than, for example, your typical yield farm on top of a spot exchange like Uniswap. Nevertheless those yield farms turned out not to be sustainable in the long run, as their yield came mostly from governance token emissions (aka inflation) leading many projects into a downward price spiral over time.

Structured product vaults solve both these problems, producing organic yield and abstracting away the complexity of option trading away for end-users. However, until recently option selling vaults were still in need of a centralized market maker buying these options from the vaults ( e.g. Deribit or Binance).

By leveraging Lyra Finance, the first highly liquid and composable option AMM in DeFi, Polynomial was able to build vaults that are easy to access, produce high yields (15-55%) and don’t rely on market makers for liquidity.

For those who want to jump (“ape” in crypto jargon) in this new product, we’ll put together a comprehensive guide, which includes the basic know-how around options and allows you to skip the countless complicated explainers you’ll find online from traditional sources.

WTF are Options?

If you don’t come from a financial background just like me, options can be quite overwhelming. Let's try to break them down in an easy to understand way. Options are derivatives, financial contracts that - as the name suggests - derive their value from other financial assets.

There are basically two different kinds of options, call options and put options, both of which I will explain later in detail. Options are contracts that allow the holder to buy or sell an asset (in TradFi mostly stocks, in crypto mostly BTC and ETH) at a certain price (which is called strike price) within a predefined time frame (called expiration).

So why would someone want to do that? There are basically two use cases for options:

-

Limit risk exposure. This is basically the objective of option buyers. To hedge the downside (FUD in crypto jargon) of an asset, the investor will buy put options. To hedge the upside (FOMO in crypto jargon) of an asset, the investor will buy call options.

-

Gain additional yield on an asset. An investor can sell options and collect premiums to gain yield on their assets (this can work for both the bullish and bearish outlooks).

This second option is what Polynomial is engaging in to produce yield for its users. It sells options on behalf of depositors.

Call options

The option seller (also called writer, owns an asset, for example ETH) gives the option buyer the possibility to acquire at a certain strike price. There can be two possible outcomes:

-

The asset price doesn't reach the predefined strike price until expiration. In that case the option seller can keep their assets and the so-called premium, which is the price paid for the option in the first place. Outcome 1 is called “out of the money” (OTM) in financial jargon.

-

The asset price reaches the strike price before expiration. The option buyer can exercise their right (note here they can, but are not obliged to do so, hence the option). The outcome 2 is called “in the money” (ITM). Note that there is a difference between American style options (which can be exercised any time before expiration) and the European style options (which can only be exercised on the expiration date).

Put options

The option seller (which deposits a collateral, e.g. USD) gives the option buyer the possibility to sell their asset (for example ETH or BTC) at a certain strike price. There are exactly the same possible outcomes of 1) OTM and 2) ITM for put options, as for the call options that we covered above.

Risks

Option sellers are exposed to multiple risks. Options are complicated and selecting the correct strike price can be quite difficult. The most obvious risk for the seller is to miss out on possible upside. Option buyers on the other hand only face the risk of losing the premium they have paid in case their option expires worthless.

How does Polynomial finance work?

Polynomial Finance uses derivatives to create products that automate various yield generating strategies. Polynomial Earn Vaults use weekly automated covered calls/put sells to generate yield from premiums and compound it by reinvesting the yield back into the vault every week. At the moment, Polynomial offers two different products that allows the users to generate yield on ETH and USD deposits respectively.

Covered call

A covered call sells the right to purchase an asset at a fixed price in the future for a premium. The vault sells the right to purchase your $ETH at a specific strike price. The strike price is usually higher than the spot price of $ETH at the time the options are minted (“Out-of-the-Money”). Then, Polynomial executes the trade on Lyra and there are three different ways your trade can go:

- The options expire below the strike price

The vault receives the premium and the ETH back as it is not profitable for the other party to exercise the options.

- The option expires at the strike price

This situation is similar to option one. The vault will receive the premium from the option and also the ETH back that was initially deposited to collateralize the CALL options.

- The option expires above the strike price

In this situation the vault receives the premium from the option but they are also required to sell the ETH to the party that purchased the original call option. This means that the difference between the current ETH price and strike price minus the premium is the loss on that particular trade. The math for this scenario looks like this:

Strike Price + Premium - Current ETH price = Loss on trade

In this situation the vault takes a loss and loses some of its principal in $ETH terms. This strategy is perfect for anyone that does not expect to see large spikes in price in a short period of time, as the vault sells options on a weekly basis and selects strike prices that allow for a moderate increase in price.

The ideal market for depositors in this vault is if $ETH goes up moderately week-by-week, so they earn premiums in $ETH while the $ value of their deposits goes up. If however, there is a sharp increase in price one week users may lose some $ETH (they’ll still be up in $ terms though as their $ETH will be worth more).This vault is currently generating yield of up to 36% which is significantly above average for this asset.

To put this in perspective with a practical example, assume investor Bob is confident that the price of Ethereum will increase. Let's assume Bob bought 1 Eth at a price of 3.000 USD and is going to deposit ETH (sETH to be exact) into Polynomial's covered call options vault. Polynomial will then automatically sell Eth call options via Lyra Protocol with a strike price of 3.500 USD and expiration of 1 week. During that week the ETH price goes slightly up but remains below 3.400 USD. Therefore, no call (buy) is triggered and at the end of the week the initial investment of 1 Eth + collected premiums from the options sold are reinvested into the vault (auto compounded). The following week, Polynomial will sell ETH call options with a strike price of 3.600 USD. The following week, ETH price sees an unexpected exceptional increase to 3.900 USD and the option buyers will exercise their call option. In this example Bob incurs a net loss since realized strike price + received premiums are still below the current Eth price.

Put Selling

Another strategy that Polynomial offers is a put selling strategy where users deposit USD instead of $ETH. This involves the user agreeing to purchase an asset (in this case ETH) at a given price (strike price) in the future. The vault sells OTM put options and receives a premium for doing so weekly. The option can go in three different ways:

-

The option expires above the strike price In this scenario, Ethereums price is above the strike price which means that the vault keeps the premium as profit and the original sUSD used to perform the put sell.

-

The option expires at the strike price

This situation is similar to the one in scenario 1, which means that the vault keeps the premium and retains the original input.

- The option expires below the strike price

In this scenario the vault makes a loss as it is required to purchase ETH at above market rate. In this situation the vault takes a loss and continues to sell weekly covered calls. The math for this scenario looks this:

Strike price - ETH price + premium = Loss on trade

This strategy is ideal for anyone that does not expect the price of ETH to fall sharply in the short-term. In comparison to the covered call strategy this strategy is subject to more risk as the user may end up in a position where they have to purchase ETH at a less favorable price and hence make a loss.

Polynomial charges an annualized management fee of 1% of AUM and a 10% annualized performance fee. The fees are prorated and are charged on a weekly basis with unprofitable weeks being excluded from any fees.

As a practical example: Investor Alice is weary of the current macroeconomic conditions and very pessimistic in regard to the price outlook of Ethereum. Alice deposits 3.000 sUSD into the Polynomial put option vault, since she believes the Eth price will suffer. Polynomial will then automatically sell put options via Lyra Protocol with a strike price of say 2.500 USD and expiration of 1 week. During that week the Eth price goes slightly down but remains above 2.600 USD. Option buyers were not able to exercise their puts and so the premium collected from the options sold are added to the vault collateral. Polynomial will sell from the now increased collateral even more Eth put options on Lyra protocol the week thereafter at a strike price of 2.400 USD. That week unexpected macro events completely destroy investor confidence and crypto assets plummet, Eth drops down below 2.000 USD and put options are exercised. Alice will incur a loss, since the premiums collected will not make up for the negative difference of the current Eth price from the strike price (at which option buyers were able to sell Eth for sUSD).

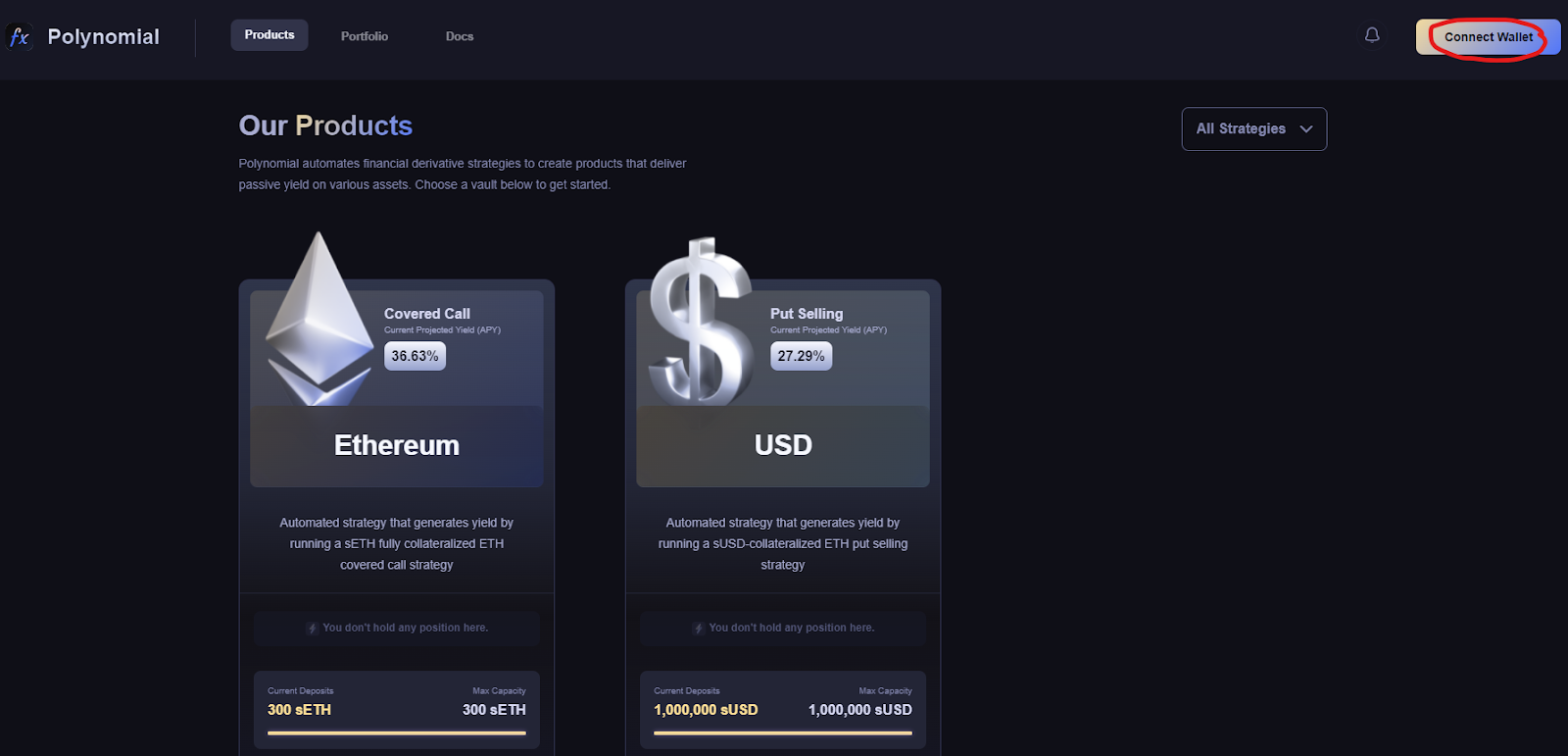

How to use Polynomial

Now that we know the basics of options let’s put this into practice and start using Polynomial protocol. As mentioned previously, Polynomial is a structured product that offers two option vaults at the time of the launch, with more to come later. Right now the user gets the possibility to invest in Ethereum covered call vault and in a put selling strategy vault. The user interface is completely straightforward, just navigate to the Polynomial website, connect your wallet in the top right corner and login via your web3 browser extension wallet.

A strategy overview is shown and is explained in simple terms. When selecting a vault, you can browse through the vault's performance, vault transactions and withdrawals and further explanation on risks & fees.

As a quick side note, Polynomial is built on top of Lyra Protocol which in turn leverages synthetic assets from Synthetix and therefore you will interact with synthetic tokens instead of vanilla $ETH or $USDC.

To get started, approve the asset you want to deposit (sETH in the case of the covered call or sUSD in the case of the put selling strategy). After the transaction is confirmed, which usually takes just a few seconds on Optimism, click on get sETH and you will be redirected to 1inch exchange in a new browser window or tab. There might be a pop up warning screen since the synthetic ETH token is not currently enabled on 1inch exchange on Optimism. Click understand and Import token, then swap as you like.

Heading back to the Polynomial interface click on preview Deposit and confirm the collateral deposit again in your wallet.

At this point the user will be able to track their positions in the Portfolio section. The deposited asset is now earning yield. In our opinion, Polynomial was able to abstract away most of the complexities from options and provide the user with an intuitive product and a sleek user interface.

Withdrawals can be requested at any time but keep in mind that Polynomial sells weekly options and therefore the actual withdrawal can only be executed after expiry of the options so you may need to wait for a couple of days before being able to access your funds. If no withdrawal is requested then the deposited collateral and the generated yield go back into the vault and the week after sells even more options, which means the yield is compounded. No user interaction whatsoever is required since everything is managed automatically by the protocol.

First of its kind

Polynomial has launched on Optimism, a Layer 2 scaling solution on Ethereum. Optimism offers extremely low fees in comparison to Ethereum and allows users with smaller budgets to enter. As well as lowering the barrier to entry, they enable easy access to high yield without the need of complicated strategies on assets that typically have significantly lower APRs.

In addition to that, Polynomial has no competitors on Optimism and other L2s which gives it a first mover advantage. The only comparable product to Polynomial is Ribbon Finance which found success on Ethereum mainnet offering various strategies and currently expanding to some alt-L1’s like Avalanche and Aurora.

Currently Ribbon holds around $270 million in assets under management and is the largest options vault provider. Polynomial can certainly expand to such levels provided the Layer-2 scaling solutions gain more mainstream adoption and increase their TVL.

At the time of writing the vaults offered by Polynomial have been completely filled and are currently at 450 sETH in the covered calls vault and 1,500,000 sUSD in the put selling vault.

Feeling optimistic about the future

Even though Polynomial has achieved plenty in a short period of time the team is working hard behind the scenes to launch more products and assets. Currently the aim is to increase TVL by opening up the vaults to a higher threshold but in the future the team is looking to expand to various other assets like Bitcoin or Solana and other option strategies such as a long or short straddle which sees the user less exposed.

Furthermore, Polynomial may eventually decide to expand and explore other L2 protocols. It is believed that the reason that they decided to make Optimism their home is due to the option liquidity that is available on Lyra. As ecosystems expand it is very possible we will see Polynomial across various different ecosystems such as Arbitrum. The team has mentioned wanting to build an option aggregator several times and wanting to become the best liquidity venue for on-chain options by aggregating liquidity from Lyra, Dopex, Premia, Hegic and many other decentralized exchanges. We’ll see what the future for Polynomial entails but it’s clear that the team is very talented and ready to shake the options space up.

Kubesqrt

about 1 month ago ·

11 min read

May 2020

What is Decentralized Finance (DeFi)?

Decentralized finance is one of the areas in crypto that has received notable traction. At a high level, DeFi aims to re-create the financial system that we use today but in a way that removes the need for intermediaries like banks.

Latest Content

April 2022

Polynomial The New DeFi Derivatives Powe...

March 2022

Courtyard: Bringing Billions of Dollars ...

February 2022

The Rise of Music NFTs - Will this unlea...

January 2022

Deep dive into Perpetual Protocol v2

January 2022

Deep dive into Treasure DAO

January 2022

Why you should use Cowswap for all your ...

December 2021

Lyra - Options Trading for DeFi

December 2021

Sorare: Fantasy Football on Ethereum

We are a multi-faceted team of crypto enthusiasts based in Berlin.

© 2021 cryptotesters UG

Products

Cryptocurrency exchanges

Crypto wallet guide

Crypto savings accounts

Defi lending rates

Crypto cards

Exclusive crypto deals

Ethereum staking

Resources

Articles

Reviews

Podcasts

Tutorials